Social Structure

Module 3

Malthusian Trap

How Was the Economy of the World in Earlier Centuries?

In the Traditional World:

- Income was mostly stagnant.

- Most places had similar per capita income.

- Minor differences due to natural advantages:

- India → Sunshine, spices, sugar

- Cities → Slightly better income due to trade/industry

- Yet, the difference was only 2x or 3x, not 50x or 60x like today.

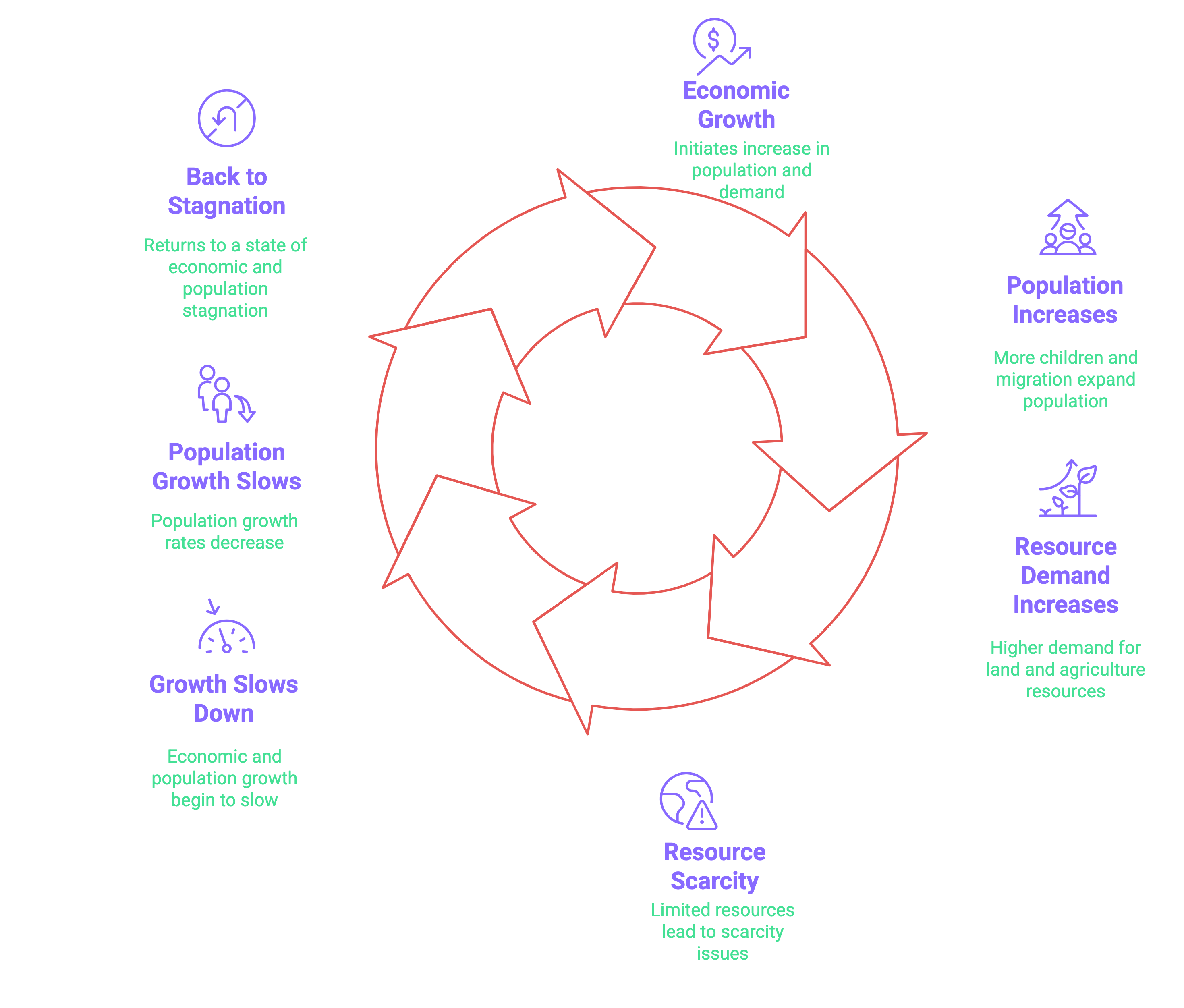

This economic similarity is explained by the Malthusian Trap. When economic conditions improved, populations grew due to better living conditions and more children. But this population growth led to pressure on limited resources like land and food, which in turn slowed down economic growth. Eventually, both economic and population growth would slow or stagnate.

How Did Economic Growth Start?

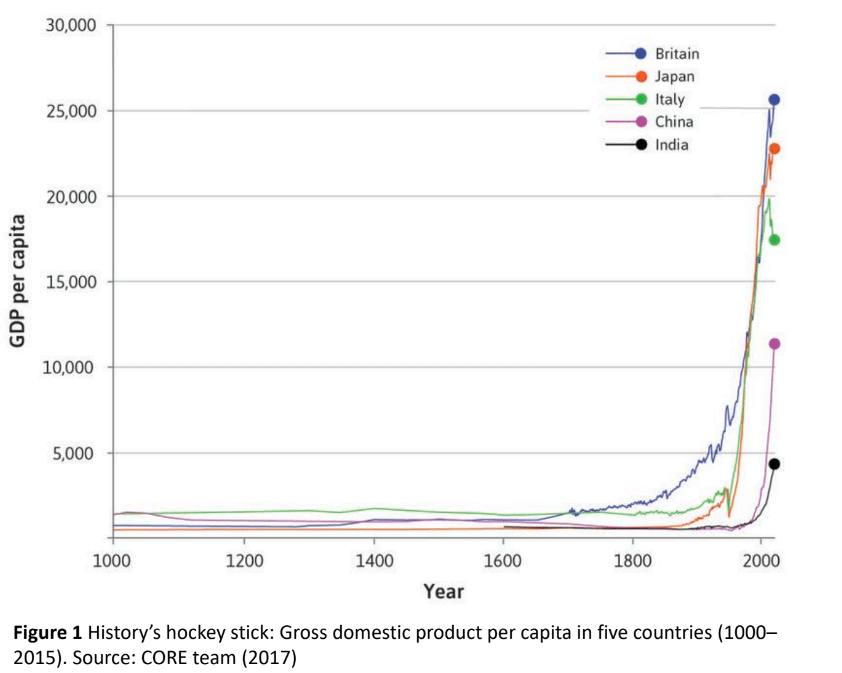

Hockey stick growth: A term used to describe the sharp upward spike in economic growth, especially after the 1750s.

Before 1500s: A Flat World

- Per capita incomes were:

- Flat and stagnant

- Similar across regions

- No region saw sustained growth for thousands of years.

After 1700s: England Takes Off

- Around 1750, England's per capita income shoots up.

- Other countries soon follow:

- Western Europe

- United States

- Japan

- East Asia (recently China & India)

Why Did Growth Suddenly Accelerate?

| Theory | Description |

|---|---|

| Technology | Innovation in machines, production, and energy (steam, etc.) |

| Colonization | Resource extraction and wealth transfer from colonies |

| Social Structure | Changes in how people related, worked, and exchanged goods |

Historically, growth rates of 1-2% were typical, but today we expect much higher growth (8-10%), which is quite uncharacteristic from a historical perspective.

Role of Social Structures

- Embedded Exchange (Traditional):

- Based on trust, power, and relationships

- Example: Village barter, feudal dues

- Contractual Exchange (Modern):

- Requires formal institutions (courts, contracts, property rights)

- Supported capitalism and industrial economies

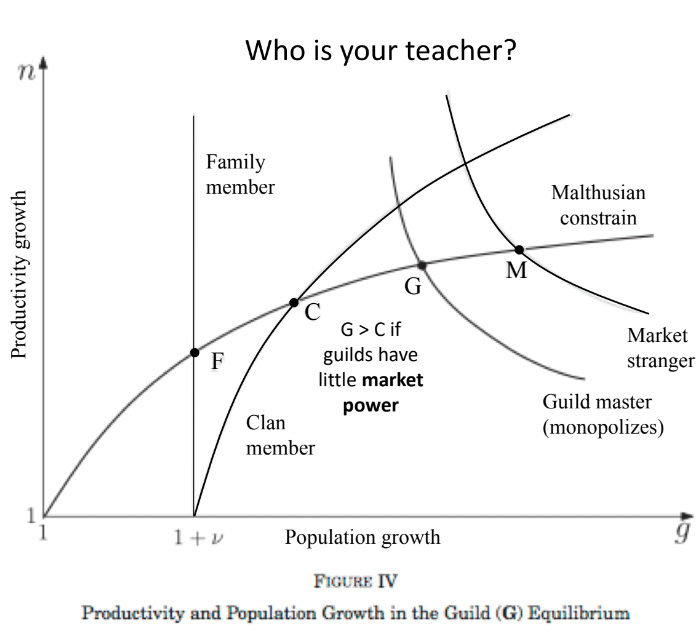

How Did Social Structure Impact Productivity?

The underlying social structure of a society significantly influences its rate of innovation, knowledge transmission, and thus, productivity growth. A thought experiment illustrates this:

| Type of Learning | Advantages | Disadvantages / Limitations | Outcome / Notes |

|---|---|---|---|

| 1. Home-based Learning | Parents are fully invested in child's success | Limited to parent's skillset | Children often inherit their parents' occupation |

| 2. Embedded Learning | Teachers (e.g., clan elders, guild masters) have better expertise than parents | Lower incentive to teach well compared to parents | Relies on reputation and community ties to ensure quality |

| 3. Market-based Learning | Access to the best available experts, even strangers | Risk of opportunism and reduced personal attention | If supported by trustworthy institutions, this model drives maximum innovation and growth |

As societies shift from relationship-based to market-based systems—with supportive institutions—the potential for innovation, learning, and economic growth accelerates, contributing to the "hockey stick" pattern in modern economic history.

Why Are Strangers So Unreliable?

-

Economic growth and innovation depend heavily on how societies manage learning, trust, and cooperation, especially in market-based systems where strangers interact.

-

The Problem of Opportunism:

- Strangers don't know each other, so there's no assurance of repeated interactions or power to enforce behavior.

- This creates a risk of opportunism, where individuals act selfishly—even when cooperation is better overall (e.g., tragedy of the commons).

-

Elinor Ostrom's Contribution:

- Studied how communities manage shared resources (commons).

- Found that communities with strong norms of reciprocity manage resources better.

- Social structures with relational trust and power help overcome opportunism.

-

Markets and Strangers:

- Markets aim to allow strangers to transact, which introduces risk.

- Philosophers have debated how this can be made possible.

-

Thomas Hobbes' View (17th Century):

- Had a pessimistic view of human nature—people are naturally in conflict.

- Believed we need a higher power (Leviathan) to govern behavior.

- This led to the idea that markets need formal institutions (courts, police, contracts) to enforce cooperation.

-

Tocqueville's View (19th Century):

- Observed Americans' ability to self-organize into clubs, associations, and cooperatives.

- Called this the "science of association"—the cultural capacity to trust and work with strangers.

- Believed that social norms and culture, not just formal institutions, can enable frictionless cooperation.

-

Two Schools of Thought on Market Governance:

- Institutional approach (Hobbes): Markets need external enforcement by laws and institutions.

- Cultural-norms approach (Tocqueville): Trust, reciprocity, and shared norms can support cooperation even without strict enforcement.

How Are Markets Governed or Regulated?

To ensure sustainable and trustworthy markets, we need to combine ideas from both Thomas Hobbes (institutions) and Tocqueville (social norms).

1. Openness (Freedom to Exchange)

- Core Principle: People must have the freedom to enter and participate in economic exchange.

- If unnecessary barriers exist (like licensing, red tape, or social exclusion), markets can't form, especially for strangers.

- Without openness, even the best institutions or norms can't help, because participation itself is blocked.

2. Institutions (Hobbesian Idea)

- Why Needed: To protect participants from opportunism (cheating, fraud, etc.).

- Includes:

- Contractual infrastructure (laws, courts, enforcement).

- Regulatory bodies (consumer forums, police, etc.).

- These institutions create fear of punishment and ensure that agreements are honored.

- They are essential when strangers transact, because trust is not yet established.

3. Civic Norms (Tocqueville's Idea)

- Why Needed: Institutions alone aren't enough. People should naturally behave in trustworthy ways, even without enforcement.

- Civic norms refer to shared social behaviors like:

- Helping strangers.

- Donating blood.

- Being honest in business.

- More civic trust = more business:

- Research (e.g., by Luigi Guiso, Paola Sapienza & Luigi Zingales) shows:

- Places with higher social trust have more business on credit or cheques.

- These places rely less on legal enforcement and more on mutual goodwill.

- Research (e.g., by Luigi Guiso, Paola Sapienza & Luigi Zingales) shows:

What Are the Factors Which Affect the Market?

1. Openness of the Market

- Factor:

- Ease of Entry - Can new people freely join the market?

- Affected by:

- Barriers like caste, guilds, or exclusive networks that restrict access.

- Freedom of trade - Legal and cultural permission to participate.

- If Closed:

- Less innovation.

- Dominance by a few old players.

- Slower economic dynamism.

2. Quality of Institutions

- Factor:

- Are rules enforced fairly and reliably?

- Affected by:

- Presence of courts, contract law, consumer protection, etc.

- Whether powerful elites influence legal systems or not.

- If Weak:

- People avoid contracts, fear cheating, and mistrust rises.

- Fewer large-scale or long-term investments happen.

3. Civic & Business Norms

- Factor:

- Do people generally behave in a trustworthy manner?

- Affected by:

- Cultural trust levels.

- Adoption of formalized business processes.

- Practices like blood donation, community cooperation, etc.

- If Poor Norms:

- More discrimination between insiders vs. outsiders.

- Markets become biased and less efficient.

Is There Any Example Where Was a Transition Into Market Based Economy?

Background: Until the late 1970s, China followed a centrally planned economy:

- The government controlled production, prices, and trade.

- There was no private ownership of businesses.

- Economic activity was based on political decisions, not market signals.

Problem: By the 1970s:

- China was economically stagnant.

- Low productivity, food shortages, and lack of innovation.

The Shift (1978): Led by Deng Xiaoping, China began to:

- Open up to the world

- Liberalize internal markets This is known as the "Reform and Opening Up" era.

Key Reforms that shifted China toward a market economy:

| Reform | Impact |

|---|---|

| Household Responsibility System | Farmers could sell excess produce in the market |

| Special Economic Zones (SEZs) | Attracted foreign companies to invest & trade |

| Allowing Private Enterprises | People could start their own businesses |

| Price Reforms | Gradual removal of government price controls |

Results:

- Massive economic growth (GDP growth ~10% for decades)

- Emergence of private sector and entrepreneurs

- Transition into the world's 2nd largest economy

- Millions lifted out of poverty